PCI DSS Certification in UK - Compliance & Assessment

Securing PCI DSS Certification in UK becomes a streamlined and efficient endeavor when partnering with a specialized PCI DSS service provider. TopCertifier, a leading PCI DSS Consultant in UK, offers comprehensive support in achieving PCI DSS Compliance, crucial for demonstrating your organization's commitment to payment card data security. Our expertise spans the entirety of the PCI DSS framework, ensuring your payment processing and data security systems align with international security standards. For expert assistance and a seamless PCI DSS Certification journey, reach out to us at info@topcertifier.com.

What is PCI DSS Certification in UK?

PCI DSS Certification in UK represents a commitment to secure payment card transactions and data protection across various industries, especially those involved in processing, storing, or transmitting credit card information. This certification is grounded in the Payment Card Industry Data Security Standard (PCI DSS), which is dedicated to establishing robust security measures to safeguard cardholder data. In UK's diverse economic landscape, encompassing sectors like retail, e-commerce, and financial services, PCI DSS Compliance serves as a comprehensive framework for ensuring payment security.

There are four PCI DSS Compliance levels based on the number of transactions completed annually:

PCI DSS Compliance Level 1: 6+ Million Transactions / Year

PCI DSS Compliance Level 2: 1 Million to 6 Million Transactions / Year

PCI DSS Compliance Level 3: 20,000 to Less Than 1 Million Transactions / Year

PCI DSS Compliance Level 4: Less than 20,000 Transactions / Year

PCI DSS (Payment Card Industry Data Security Standard) is the global standard that outlines policies and procedures for the secure handling, processing, storage, and transmission of cardholder data by merchants and other entities.

Adhering to the requirements of PCI DSS ensures that payment card security systems will be of real benefit to your organization to help manage and protect cardholder data effectively and put in place best practice security measures.

How To Achieve PCI Compliance in UK?

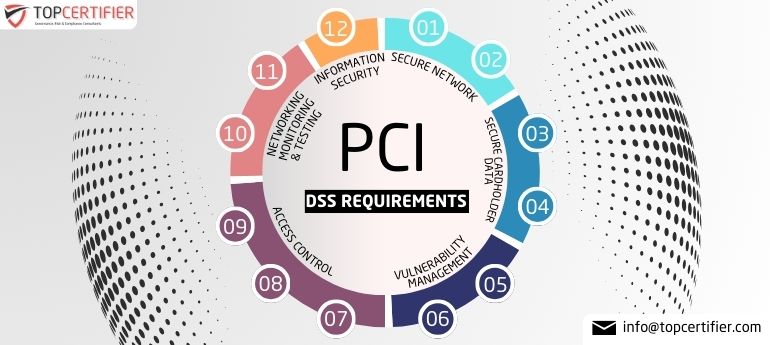

For businesses in UK, becoming PCI DSS Compliant is crucial for ensuring secure payment card transactions. The PCI Security Standards Council (PCI SSC) has established 12 key requirements, grouped under 6 objectives, to guide businesses towards compliance. While some requirements may vary depending on the merchant level, this overview is tailored for level 4 merchants, typically small businesses.

Requirements for PCI DSS Compliance

Building and Maintaining a Secure Network

- Install and maintain a firewall configuration to protect cardholder data.

- Avoid using vendor-supplied defaults for system passwords and other security parameters.

Protecting Cardholder Data

- Ensure the protection of stored cardholder data.

- Encrypt the transmission of cardholder data across open, public networks.

Maintaining a Vulnerability Management Program

- Monitor and track all access to network resources and cardholder data.

- Develop and maintain secure systems and applications.

Implementing Strong Access Control Measures

- Limit access to cardholder data based on business need-to-know.

- Identify and authenticate access to system components.

- Restrict physical access to cardholder data.

Process Regularly Monitoring and Testing Networks

- Monitor and track all access to network resources and cardholder data.

- Conduct regular tests of security systems and processes.

Maintaining an Information Security Policy

- Uphold a policy that addresses information security for all personnel.

While this list of requirements may seem extensive, it represents the minimum necessary steps to safeguard sensitive cardholder data. The good news for British businesses is the availability of various tools and solutions designed to assist in achieving and maintaining PCI DSS compliance. Among these resources, TopCertifier stands out with its team of Qualified Security Assessors (QSAs) who are well-equipped to guide businesses through the complexities of data security standards.

What are the Benefits of PCI Certification in UK?

Achieving PCI DSS Certification in UK can significantly benefit your business, enhancing the security of payment card transactions and protecting customer data. This certification impacts every aspect of the business, from e-commerce and retail to financial services and customer relations.

- Enhanced Payment Security

- Increased Customer Trust

- Compliance with International Standards

- Reduced Risk of Data Breaches

- Improved Reputation

- Systematic Approach to Data Security

- Better Risk Management

- Continuous Improvement in Security Practices

How much does it cost to achieve PCI DSS Compliance in UK?

The cost of PCI DSS compliance can vary greatly and is influenced by several factors. The type of business you run, whether it's a large corporation, a small company, or a service provider, plays a significant role. Larger businesses with more employees, systems, and data typically face higher compliance costs due to the complexity and scale of their operations. The culture of security within your organization also matters. If your management prioritizes data security, budgeting for compliance is usually less of an issue. However, if there's less awareness or emphasis on security, convincing leadership to allocate funds can be challenging.

The technical environment of your organization, including your network setup, the types of systems and devices in use, also impacts the cost. While having a dedicated PCI team is beneficial, most organizations still require external expertise to ensure full compliance. Lastly, some businesses might have part of their compliance costs covered by their acquiring banks, but this is not a common practice.

TopCertifier - Your Ideal ISO PCI DSS Compliance Service Partner in UK

TopCertifier, a leading PCI DSS compliance service provider in UK, offers expert guidance and support for businesses navigating the complexities of PCI DSS certification. Our certified PCI DSS assessors, recognized by the PCI Security Standards Council (PCI SSC), specialize in evaluating the technical and operational components of systems handling cardholder data. We ensure these systems meet the rigorous standards of PCI DSS, covering essential areas such as encryption, authentication, data retention, physical security, and data protection. Our comprehensive services include detailed annual PCI Audits, which are crucial for any organization involved in credit card transactions.

Partnering with TopCertifier for PCI DSS compliance is a strategic decision for businesses aiming to safeguard their customer's cardholder data. Failure to comply with PCI DSS standards can lead to significant fines and penalties, making our role vital in protecting both the financial and reputational integrity of our clients. With our expertise and support, businesses can confidently achieve and maintain PCI DSS Certification in UK, ensuring a secure and trustworthy payment environment

PCI DSS Templates Free Download

Our Expertise

- ISO 9001 Certification in UK

- ISO 14001 Certification in UK

- ISO 45001 Certification in UK

- ISO 22000 Certification in UK

- ISO 20000 Certification in UK

- ISO 22301 Certification in UK

- ISO 27001 Certification in UK

- HACCP Certification in UK

- CE Mark Certification in UK

- PCI DSS Certification in UK

- HIPAA Certification in UK

- CMMI Certification in UK

- SOC 1 Certification in UK

- EU GDPR Certification in UK

- ISO 17025 Certification in UK

- ISO 13485 Certification in UK

- ISO 26000 Certification in UK

- ISO 50001 Certification in UK

- SOC 2 Certification in UK

- SOC 3 Certification in UK

- ISO 22301 Certification in UK

- ISO 27701 Certification in UK

- HITRUST Certification in UK

- ISO 27017 Certification in UK

- ISO 27018 Certification in UK

- NIST Certification in UK

- TISAX Certification in UK

- FISMA Certification in UK

- COBIT 5 Certification in UK

Related tags

PCI DSS Certification in UK, PCI DSS Compliance, PCI DSS Audit, PCI DSS Assessment, PCI DSS Inspection, PCI DSS Qualified Security Assessor (QSA) Services, PCI DSS Accreditation, PCI Data Security Standard Requirements, PCI Certification, PCI DSS Requirements, PCI DSS Certified Company, PCI DSS Certification in London, PCI DSS Certification in Leeds, PCI DSS Certification in Newcastle, PCI DSS Certification in Liverpool, PCI DSS Implementation, PCI DSS for Retail, PCI DSS for E-commerce, PCI DSS for Financial Services, PCI DSS for Service Providers, PCI DSS Consultancy, PCI DSS Certification Body, PCI DSS Documentation, PCI DSS Standard Guidelines, PCI DSS Awareness Templates, PCI DSS Internal Audit Report, PCI DSS Audit Checklist, PCI DSS Security Process, PCI DSS Compliance Cost, PCI DSS for Small Businesses, PCI DSS for Large Enterprises, PCI DSS Risk Assessment, PCI DSS Security Controls, PCI DSS Compliance Solutions, PCI DSS Training Programs, PCI DSS Compliance Strategy, PCI DSS Data Protection, PCI DSS Network Security.